Feeling like the stock market is choppier than ever?

Your right.

As someone who watches markets daily, the last few years have been relentless – Stomach-churning moves have become a constant – Each year more volatile than the last.

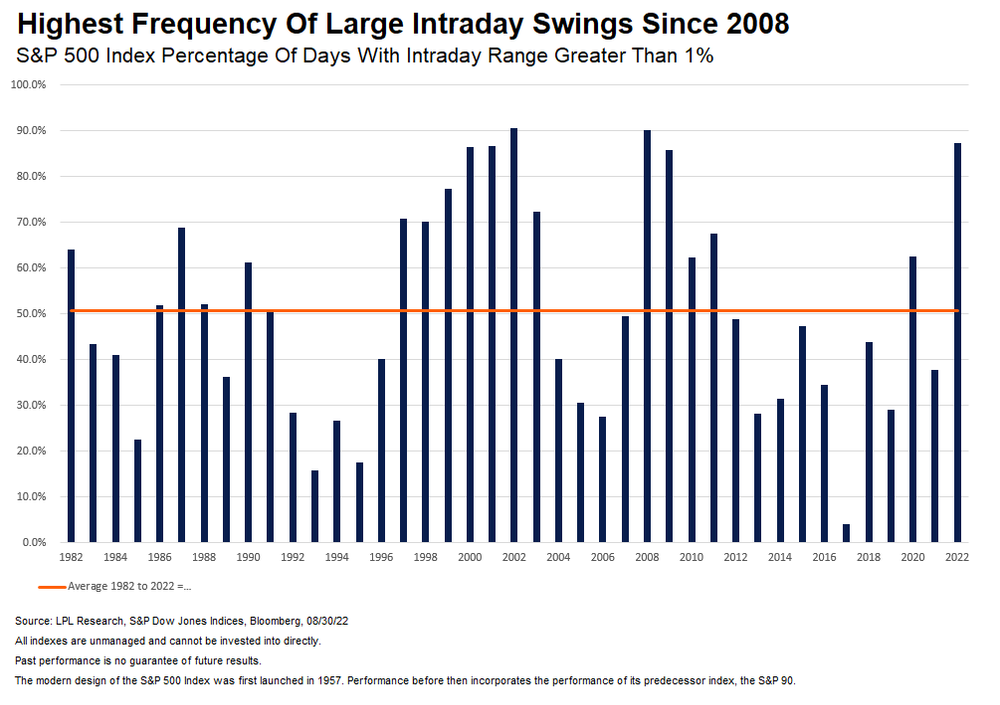

Data from ,,LPL financial shows

87.3% of all days (to September 2022) had intraday swings of over 1%. This is the highest incidence of such large intraday ranges since the Global financial crisis.

For context, in 2020 when the entire world was coming to an end, only 62% of days saw intraday moves of over 1%.

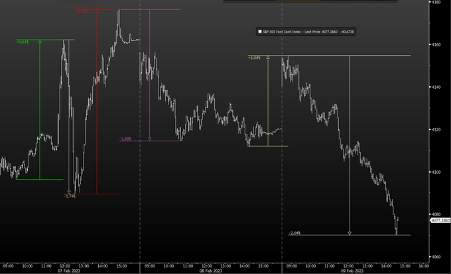

2023 volatility has picked up where 2022 left off.

At the start of February, we saw six reversals of 1% or more in just 3 days.

Over that same 3-day period, there were 2 reversals of more than 2%

Violent Swings in 2023

Source: @biancoresearch

We are experiencing 2008 levels of volatility, perpetually.

At least that’s what it feels like.

But what is really causing this volatility, and how can we profit from it?

What They Tell You Is Causing It?

‘Macro-economic uncertainty’ is usually top of the list.

Undoubtedly, economic uncertainty has a role to play here.

However, using ‘uncertainty’ as a blank statement to explain away the intricacies of the market is just laziness.

It’s the easiest answer, but it’s not the correct one.

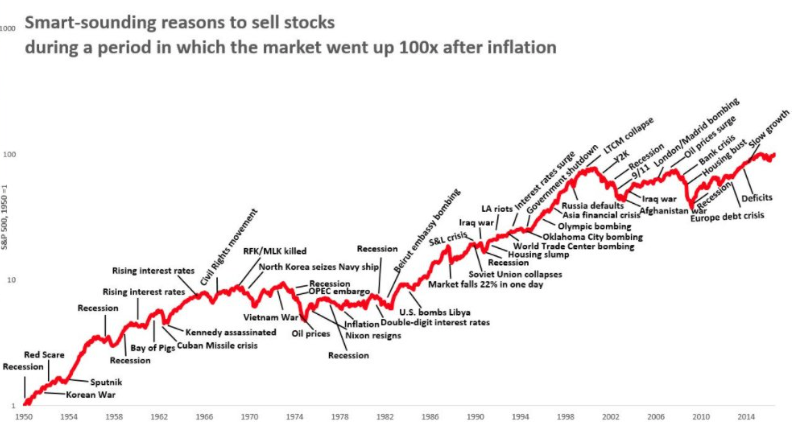

People talk about the current levels of uncertainty as if there has never been uncertainty before.

As if, before now, we all just existed in a utopian state of calm.

Newsflash, we didn’t.

There has never been a clear path on the horizon. The immediate problems just seemed more pronounced when they are looming over us.

History is just one damned thing after another.

The world is one big conveyer belt of uncertainty. We are always one mis-step away from an existential crisis.

But we’ve made it this far. We’ve probably got a good chance at making it through the next thing, too.

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

– Warren Buffet

For me, the macro outlook has a huge part to play when it comes to the direction of travel, but there are other forces at play, accelerating the rate of change we are experiencing.

Want Investment Ideas That Won’t Bore You To Death?

1. Trading Volume

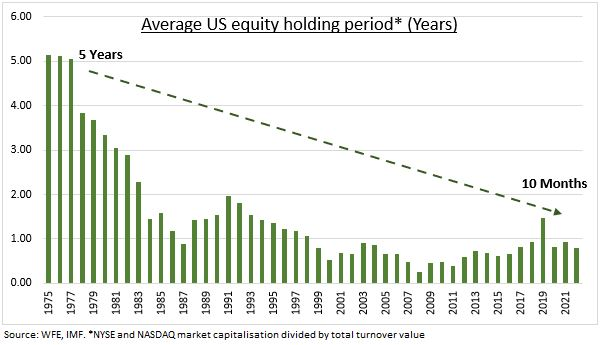

According to new analysis from eToro, the average holding period for U.S. stocks was 10 months in 2022. This is down from more than five years in the mid-1970s.

There is a lot of talk about the emergence of retail traders and their impact on the investment landscape in recent years.

The underlying narrative goes something like this.

,‘We all used to be responsible savers and investors and now everyone fancies themselves as a trader and this 7x reduction in holding periods is evidence of this‘

Those pesky kids with their low-cost brokerage accounts and Reddit Forums eh.

I just don’t buy it.

Of course, ease of access, technology, quant trading, more liquid product offerings, improved exchanges, zero commission trading, and an entire universe of investing information at our fingertips will change investment behaviours.

But the ‘5-year holding period’ trend fell apart back in 1983.

You can’t blame recent volatility spikes on ‘short-termism.’ The market has been ‘short-term’ for decades.

Instead of pointing to the holding period trends, I think it is more important to look at the sheer volume of trades.

-

- In 1930 Roughly 5 million shares a month were being traded.

-

- Today, The New York Stock Exchange averages well over a billion shares traded per day.

-

- Stock market participation has gone from close to zero to 50% over the same period

Hedge funds, ETFs, mutual funds, high-frequency traders, pensions, endowments, foundations, family offices, and retail traders all now clambering for position inside one noisy, crowded market.

,Not everyone in the stock market is suddenly a degenerative gambler, but the ease of access has brought a flurry of new players, all desperate to make their mark.

You’re unlikely to get much peace in such a crowded house.

Actionable Investment Tips Directly to your Inbox

2. Trading Options

For me, the instruments that are being traded and the volume at which they are being traded play a considerable role in the daily swings we are seeing.

There is an endless list of these, but the new crowd favourite is ‘zero-day options’

Don’t get me wrong, options themselves are not the issue. Options can serve a valuable purpose for many looking to hedge market exposure relatively inexpensively.

However, huge volumes of highly leveraged daily directional bets have intensify the daily swings we are experiencing.

The tail is starting to wag the dog.

Zero-Day Options:

Similar to a popular British wood stain….It does exactly what it says on the tin.

Like any options contract, 0DTE options give traders the right to buy or sell a quantity of an underlying security at a specific future price.

But in this case, the contract expires within a day.

This can benefit traders as it removes the time decay into expiration, which is common with longer-term contracts.

What you are left with, is a short-term pure-play directional bet on the market.

What’s not to love?

Every man and his dog is cursing the impossible task of predicting where the market will be three months from now.

nn

So why not roll the dice and make a leveraged bet on what direction the market will move today? That’s an easier call, right?

,Example

Suppose Apple is trading for $100 per share. You buy a call option contract with a strike price of $100, expiring today.

You are just making a bet based on your expectation that the actual stock price will be higher than the strike price by the end of the day.

Each options contract represents 100 shares in Apple. The premium you have to pay for the chance to capture the upside is $1 per share or $100 total.

If the stock surges to $105, you get the upside, less the premium paid. ($5*100) – ($1*100). That’s a 4x return in a single day, not bad.

Of course, If the stock doesn’t rise or falls, you will be down the cost of placing the bet ($100 premium in this case)

,The Problem

According to OptionMetrics.

Over recent months, record numbers of zero-day options that track the S&P 500 have changed hands — with volumes of about 1.5mn a day in November — more than double the levels in January and almost four times those at the start of 2020,

Now I’m not naive enough to think the markets should be free of speculation. Everyone is speculating in some shape or form. Some do it under the guise of risk-adjusted probabilities. Others are blatant gamblers.

The game you choose to play is entirely up to you, but there needs to be controls in place to ensure that the mechanisms through which we trade simply facilitate the price.

Unfortunately, the increased use of these options contracts can manipulate and dictate the price.

Real Money Pro’s Doug Kass recently wrote

“The recent proliferation of ODTE options (zero days to expiration) has become a dangerous force…Whether you call it speculation or manipulation – it’s serving up extreme and unpredictable intraday volatility. My experience is that these sorts of artificialities end very badly for trading types and for our markets.”

,The Tail that Wags the Dog

‘Gamma-squeeze’ became the investment buzzword of choice as reddit traders bet the house on BBB and GameStop, but we see this all the time.

In January, significant short positions got squeezed as last year’s worst-performing stocks started to bounce off the lows. As these stocks climbed higher, traders holding short positions were forced to cover their positions by purchasing the stock, creating more demand and pushing the price higher. From there, the loop just feeds on itself. You have heard it all before.

Before you know it, a small price adjustment evolves into a full-blown ‘junk stock rally’.

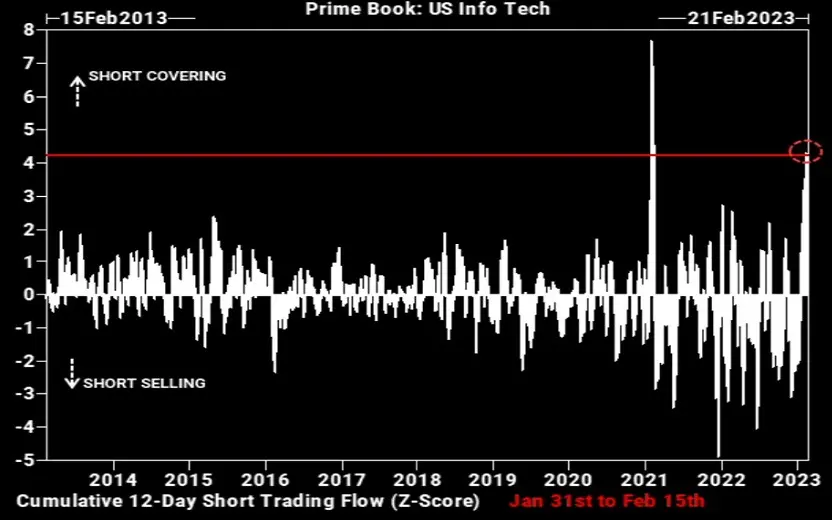

January 31 to February 15th saw the second-most short covering in US tech stocks by hedge funds in any comparable period in the past decade.

Source: Goldman Sachs

But hey, why do we need to care about violent swings to the upside?

A couple of big hedge funds got squeezed, and markets move higher as a result.

Everyone’s a winner.

But what happens when it works in the opposite direction? When an overflow of out-of-the-money puts starts a vicious cycle in the opposite direction? Forced selling as everyone is rushing for the exists

The squeeze can work both ways.

Options like this clearly aren’t going to disappear overnight, but volume control is needed. Otherwise, the ‘harmless’ rallies will turn into painful ‘flash crashes’ before we know it.

Put simply, these are not hedging mechanisms. These are gambling tools benefiting those desperate seeking a hit of volatility.

If you are a long-term investor, it can help to be mindful of some of the mechanisms at play regarding price action. Understanding what is dictating stock price movements over the short term will make it easier to block out the noise and focus on the game you’re playing.

As always, please reach out to me directly at mike@theislandinvestor.com if you have any questions.

Always happy to help.