Chat GPT vs BARD

In recent weeks, investors have raised an unthinkable question.

Could googles impenetrable moat be under threat?

The emergence of Chat GPT, googles blundered retort and Satya Nadella’s rise to Guru CEO status have raised eyebrows.

“I hope with our innovation they will definitely want to come out and show that they can dance. I want people to know that we made them dance.”

,-Satya Nadella, Microsoft CEO, when speaking about googles attempts to compete with Bings A.I Offering

The gloves are off.

Google may well emerge victorious in the A.I. wars, but as Microsoft stand over googles cash cow with a shotgun in hand, one thing is clear. Google’s impenetrable fortress has been breached.

Who do I think will win? I actually think they could both lose but that’s for another day.

For now, there are 3 important lesson for investors hidden in all this A.I drama.

1. Nothing Last Forever

The never-ending pursuit of progress inevitably leads to creative destruction.

New business innovation displaces incumbents who were once the undisputed market leaders.

Companies we thought would last forever, fade into the abyss as new technologies make their offerings redundant.

We convince ourselves it will never happen, not this company, but it happens all the time.

The revolving door of winners and losers is constantly spinning.

As I have mentioned before,

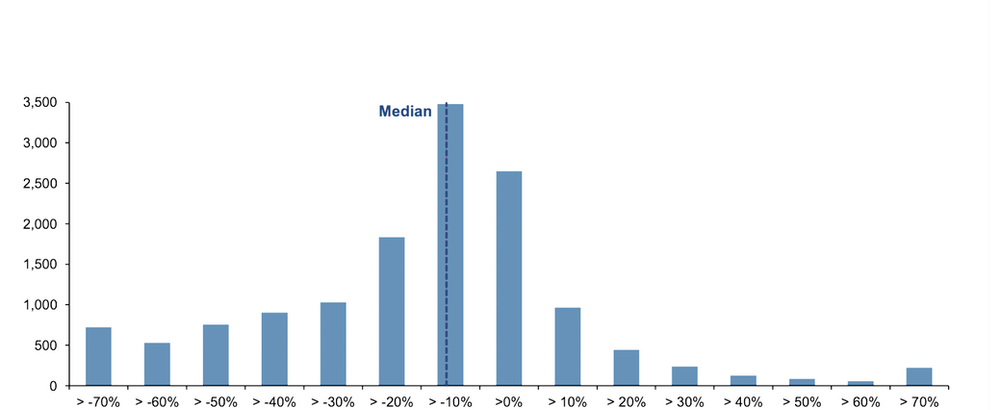

More than 40% of all companies that were ever in the Russell 3000 Index experienced a “catastrophic stock price loss”, defined as a 70% decline in price from peak levels which is not recovered.

40% OF COMPANIES…CEASE TO EXIST!!!

We often talk of the phenomenal gains generated by the stock market over time, but we rarely appreciate the graveyard of fallen companies hidden in the numbers.

Remember Blackberrys…. or going to physically rent a movie….. Ya me neither.

Remember this gem. 2 hours watching a movie…. 6 hours picking it out. RIP to a childhood staple.n

Survivorships bias ensures that we revel over the winners while the losers slip into insignificance, wiped from memory.n

This selective amnesia tricks us into thinking this game is easy.

It’s not.

2. It’s Not as Easy as you Think

This revolving door of companies is part of what makes stock picking so hard. Despite what the headlines suggest, the probability of you picking a winner is lower than you think.n

While the Russell 3000 index has returned an average annualised return of 13% since 1980. The disparity of returns that generate these profits is rarely focused on. n

The vast majority of the positive returns over time can be attributed to just 7% of stocks; the ‘mega winners’.

Meanwhile, the median stock in the Russell 3000 underperformed the index by -10% on average since 1980.

Distribution of excess lifetime returns on individual stocks vs. Russell 3000 1980-2020

Source: JP Morgan

There seems to be a narrative in the market suggesting that stocks typically go up over time and therefore, with a little bit of homework, ‘my’ stocks picks will go up even more, but it isn’t that simple.

The concentration of winners is more severe than you think.

Remember, while the stock market has historically provided positive returns, picking individual names remains a difficult feat, with the odds very much stacked against you.

This isn’t a 50/50 coin toss.

3. Always Question your Conviction

Everything you think you know is based on current available information, but the information is always changing.

To quote Morgan Housel

Every company valuation is simply numbers from today multiplied by a story about tomorrow.

You have financial statements that give you an insight into how the company is performing at a specific moment in time, but it will be the future growth projections from management and market analysts that ultimately determine the price.

Take Tesla. Revenue and cash flows provided insight into the company’s performance, but it was predictions about future automated driving capabilities, battery production capacity and a world pivoting towards electronic vehicles that drove the company to its trillion-dollar valuation.

In 2022, the revenue and cash flows are better than they had ever been, but the story about tomorrow was fading, and the company’s stock price fell 65%.

Tesla Stock Price

Source: Tradingview

While the numbers from today can be quantified, the story about tomorrow is driven by the future growth possibilities of the company.

These possibilities can seem rational at any one moment, but in reality they are largely unknown.

Be careful how much weight you put on the future stories the market is telling you. As the information changes, so too will the story.

Google appeared impenetrable, and then open A.I came along and changed all that.

Things we never thought would happen, happen all the time.

One thing I see a lot is people peddling the importance of having ‘conviction’. Understanding what you are investing in and why you are investing in it is crucial but don’t get conviction mixed up with blind overconfidence.

Unrelenting conviction is just laziness masquerading as certainty.

Stay on your toes.

To quote John Maynard Keynes

When the facts change, I change my mind. What do you do?