Stock Market Surge

In recent weeks, we have seen a considerable rally in the stock market.

Lower-than-expected inflation prints have been well received, resulting in the largest one-day rally in over two and a half years. Some of this exuberance can be attributed to technical factors driving some of the most shorted stocks higher but there is no denying, the latest monthly CPI figures have provided some much-needed respite for investors.

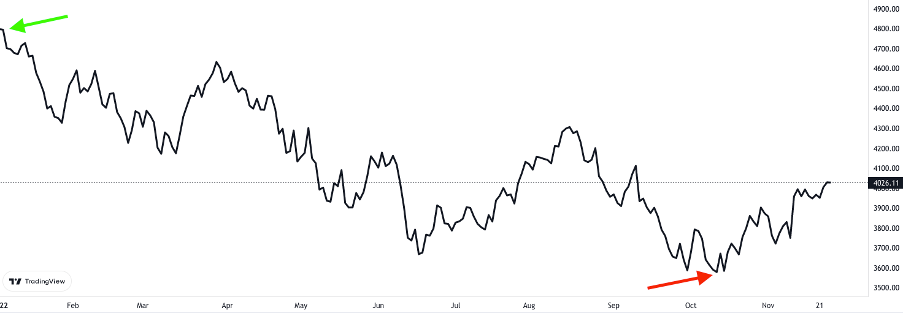

The S&P 500 index is now up 10.9% from its October 12 closing low of 3,577.03 and down 17.3% from its January 3 closing high of 4,796.56.

S&P 500 YTD Performance

Source: TradingView

So as improving inflation numbers push markets higher, should investors be jumping in headfirst to avoid missing yet another market rally?

Not quite.

Not Out of the Woods Yet

In the last two years, we have seen rapid market recoveries play out at breakneck speed as Monetary support, ultra-low interest rates, and fiscal stimulus all conspired to drive markets higher.

In simple terms, when money is free, and governments are hell-bent on continuously printing more and more of it, asset prices increase.

This exuberance pushed prices and valuation multiples to questionable highs. Now, however, the money printer has been turned off, and interest rates have increased dramatically, leaving us in a far less supportive environment. Unsurprisingly, asset prices have fallen accordingly.

This year’s pullback has stripped out much of the excess from markets, leaving stocks trading at much more attractive prices.

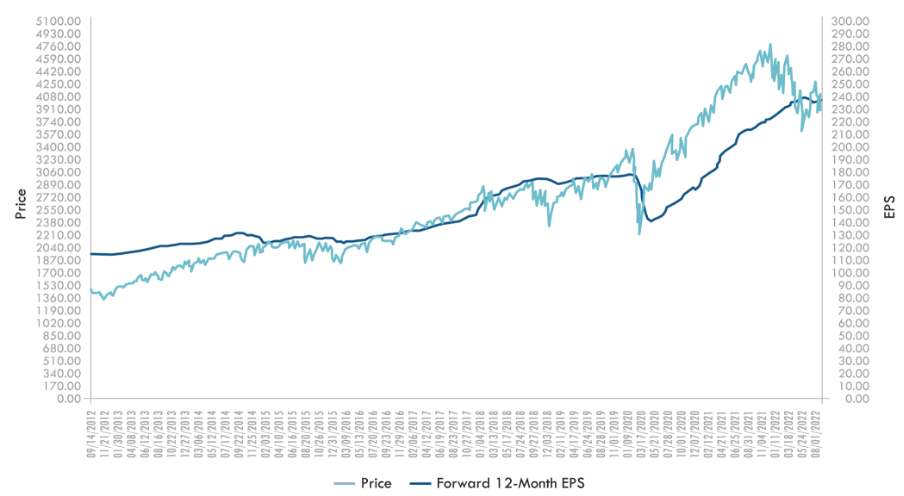

The forward 12-month P/E ratio for the S&P 500 has fallen from over 30 in 2021 to 19. This P/E ratio is now much closer to the 10-year average of 17.0.

The S&P 500’s P/E multiple Falls Dramatically

Source: Factset

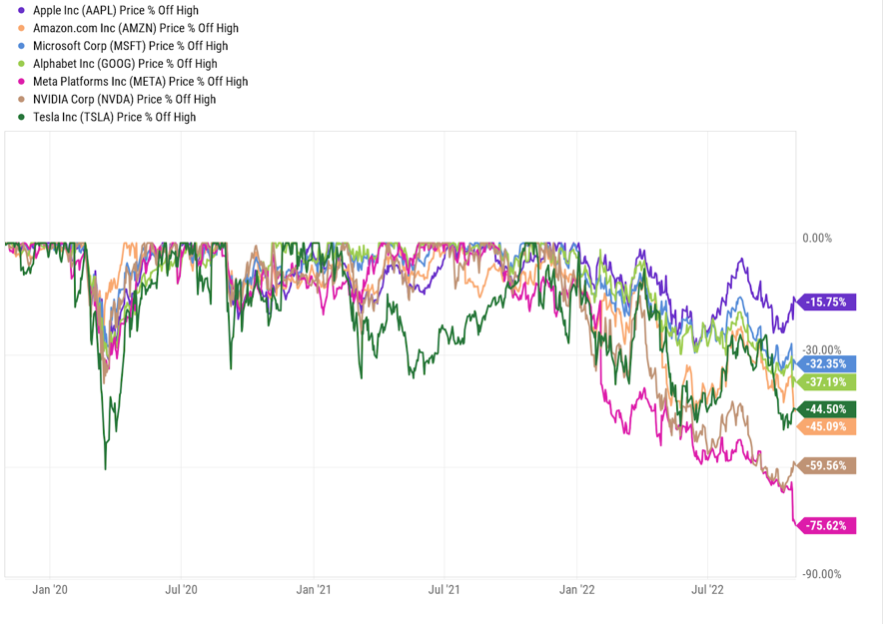

Household names such as Google, Microsoft, Amazon, Tesla, Disney, Nike, Netflix, and Facebook have fallen between 30% and 75% in recent months. Now, the entry points into some of the most well known companies in the world are much easier to digest. This is welcomed news for investors with a long-term outlook. But over the shorter term, it is vital to realise that many of these names are trading lower for a reason.

2022 Drawdowns

Source: Ycharts

It can be tempting to assume we will return to all-time high valuations now that inflation is starting to turn and markets have stripped out much of the excess in valuations. However, as we stare down the barrel of falling earnings, slowing economic activity, a less supportive monetary policy and persistent inflation, it would be naive to think that it’s all upside from here.

As the sugar rush of falling inflation fades, market participants will be left wrestling the looming recessionary pressures.

Considering all the above, I believe the stock market will remain within the 10% range it has traded in over the last month. This is likely to result in volatile horizontal trading over the coming weeks and months as positive moves due to falling inflation eventually give way to market declines as earnings growth continues to slow.

What Does this mean for 2023?

Like most things in life, it is the difference between expectation and reality that dictates the severity of our reaction.

Regardless of how bad the reality turns out to be; if your expectations were worse, your reaction will be positive and vice versa.

So, to understand how markets will react, we must first analyse the market’s expectations.

On the equity side, 2023 forward earnings projections for the S&P 500 are set at 5%. While this represents a significant slowdown in growth relative to what we have experienced since the pandemic pullback in early 2020, I view this as optimistic, given the considerable change in monetary and fiscal policy in 2022.

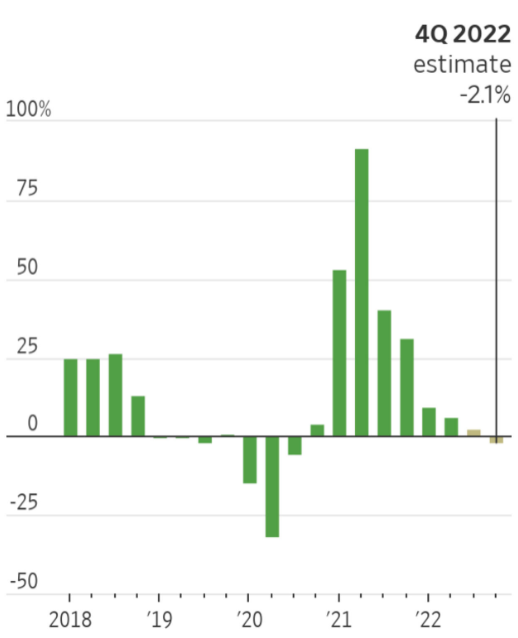

Q3 looks likely to finish at 2% year over year growth, the weakest since the height of the pandemic. Ex-energy, performance becomes weaker again.

Looking ahead to Q4 2022, analyst are now predicting the first negative quarter since 2020, with profit growth falling to -2%. These Q4 earnings predications from the same analysts were as high as 9% as recently as June.

See if you can spot the trend.

S&P 500 Quarterly Earnings

Source: WSJ

While expectations for ‘23 are still at plus 5% earnings growth, I wouldn’t be surprised to see 2023 earnings forecasts suffer the same faith as the Q4 2022 forecasts.

As leading indicators continue to point towards a slowdown in economic activity, a base case of positive 2023 earnings growth becomes difficult to justify in my opinion. This may result in some negative earnings surprises in the second half of 2023.

In Fixed Income markets, the Fed has reiterated its plan to hold rates higher for longer, and this expectation is reflected in markets.

According to the market-implied Fed Funds Rate, investors are now expecting the Fed Funds Rate to peak at 4.9% in 6 months and remain well above 4% into 2024.

My view: The probability of the Fed maintaining a long pause as we enter more economically uncertain times is not as high as the market is predicting. I believe a pivot is likely before 2024 as earnings and labour markets weaken.

In short, while the lows for multiples may already be in, a mild earnings recession playing out in the second half of 2023 may result in a slow grind lower for the stock market.

I believe this pullback in earnings and labour will prompt a pivot from the Fed, cutting rates in an attempt to avoid the re-emergence of the disinflationary forces that provoked a decade of QE through the 2010’s.

While it is impossible to know the exogenous shocks that lie ahead, buying up short-term Treasuries, maintaining a tilt toward ‘value-based’ equity staples will protect if the current economic slowdown persists.

Summary

The market appears to be moving past its overwhelming obsession with inflation, but unfortunately, this paves the way for all new worries. The slowing economic activity that is allowing inflation to fall in the first place now becomes enemy number one. Softer demand will lead to lower spending, leading to lower earnings which should theoretically lead to lower stock prices.

Unfortunately, the ferris wheel of worry continues to spin.

Over the long-run, opportunities are more plentiful than ever as valuation multiples improve but for those expecting smooth sailing now that inflation has shown early signs of retreat, think again.