Facebook: The company everyone loves to hate is down over 60% in under a year but is that enough to make you love it or just one more reason to stay away.

Frankenstein’s Monster

In her 1818 Novel, Mary Shelley introduced the world to Frankenstein’s monster. In her tale, she details the life of gifted scientist Victor Frankenstein who succeeds in giving life to a being of his own creation.

However, this is not the perfect specimen he imagined, but rather a hideous creature who is rejected by Victor and later seeks murderous revenge against his creator.

In Mark Zuckerberg’s modern-day adaptation, he successfully gives life to a social network of his own creation but later loses control of his monster as the network turns evil beyond repair.

Both stories highlight the danger in the pursuit of knowledge and advancement in Science and Technology.

“knowledge is shown to be double-edged, its benefits and hazards depending upon the circumstances, and the spirit, in which it is pursued”

The Social Network

I have never been a fan of social media and have tried my best to avoid it in recent years. As someone whose own narcissistic tendencies constantly threaten to engulf their entire personality, I don’t need a platform based on inane social acceptance to add propane to the already untenable fire.

I can destroy every fabric of my self-worth on my own, thank you very much.

But hey, that’s just me. My wife uses it all the time, and she loves it. She seems to possess the rare ability to use it for what she wants it for, extracting everything she needs from it without getting sucked into the bullshit. I, on the other hand, hurdle myself uncontrollably towards said excrement.

*(Of course, there are positive impacts of social media, but I am feeling particularly cynical this morning so forgive me for leaning more on the apocalyptic side)

Despite my personal disdain, social media and its role in our lives is more prevalent than ever.

It has deep-rooted societal effects and irrevocably changed how we interact, work, play and consume information.

As the largest current player in this space, Facebook and its family of apps have dominated the market, generating mind-blowing revenues and profit margins while holding a globe-straddling monopoly over the digital advertising space.

But as that monopoly slips from their grasp and the stock price collapses, is this the end for Facebook or just a momentary blip in one mad scientist’s pursuit of world domination?

A Scandalous Past

You don’t just go from being one of the biggest companies of the last decades to an investment outcast for no reason.

So what happened?

For the last number of years, the social media giant has been a scandal factory. From challenging the very fabrics of democracy during its Cambridge Analytica days to more recent ‘Facebook Files’ reports showing a wide range of controversial issues, including severe shortcomings in response to human trafficking and terrorism activity on the platform and inaction following the firm’s own research showing the harmful effects their platforms have on its users, particularly teenagers and young girls.

For years, Facebook’s newest PR scandal seemingly only functioned to trump the prior scandal in some sort of twisted scandal one-upmanship, and yet the stock price kept on rising.

Like Teflon, nothing would stick.

Despite the toxic nature of their products and multiple whistleblower scandals that would have irreparably damaged any other company, Facebook’s stock price doubled as the scandals rolled in.

So, how did a company that focused its business model around destroying our social fabric through the creation of polarised echo chambers manage to cement itself as one of the most successful companies in modern history?

As the old Greek guy once said, ‘It’s easier to forgive you when you’re making me so much money’

But what happens when the money stops rolling in.

You abruptly change every single thing about the company…. OBVIOUSLY!

The Change-Up

Facebook’s (META) rebrand needs little introduction.

The logic behind Facebook’s aggressive redirection is up for debate, but the below were surely top of the list.

-

- Distract from substantial growth issues across its core business

-

- Deflect attention away from increased media and regulatory scrutiny

-

- Distance themselves from Facebook’s lack of brand appeal among young people through a rebrand

I would imagine the Facebook board would have preferred to keep the cat in the proverbial bag until the ‘Reality Labs’ division of the business had graduated from its infancy, but for better or worse, external pressures seemed to exacerbate the size and speed of the META role out.

Companies attempt to generate new business lines all the time, nothing new there. It’s Facebook’s aggressive approach that raised eyebrows.

Google has trialled far-out, sci-fi-sounding technologies such as autonomous driving for years. The difference is, they do it quietly through their ‘Moonshot Division.’

This separation ensures google continues to prioritise its core operating business while placing small bets on future technology without the pressure of the company’s entire future resting on the success of those technologies.

While Google is sitting at the roulette wheel placing several small bets, Facebook has gone all in.

A questionable strategy, but fortune favours the brave and all that.

The Wheels Fall Off

While the rebranding approach may have seemed erratic, it can hardly be blamed for the massacre that followed.

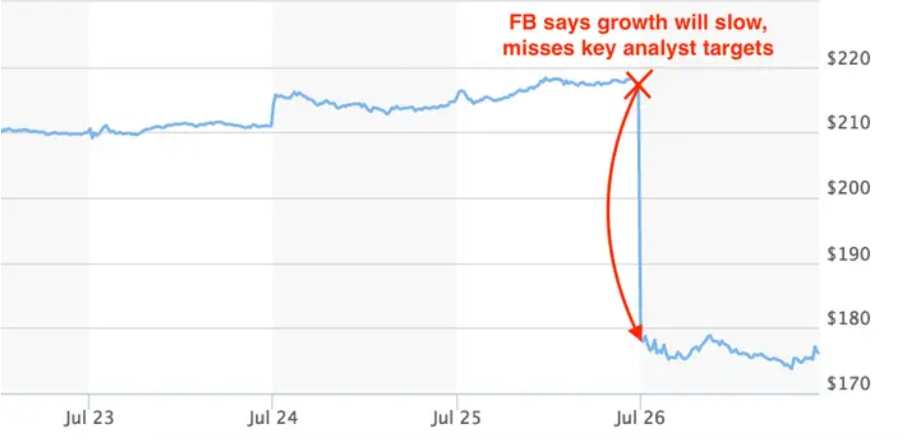

Facebook’s Q4 earnings report in February 2022 was the catalyst for the current decline.

Here, Facebook announced its first-ever drop in daily active users. The stock subsequently fell 26% and eroded $250 billion from Meta’s market cap to record the largest one-day decline of a company’s valuation in market history.

The Largest One Day Loss for a US Company Ever

Source: Marketwatch

The endless growth story was over, and investors adjusted their valuations accordingly.

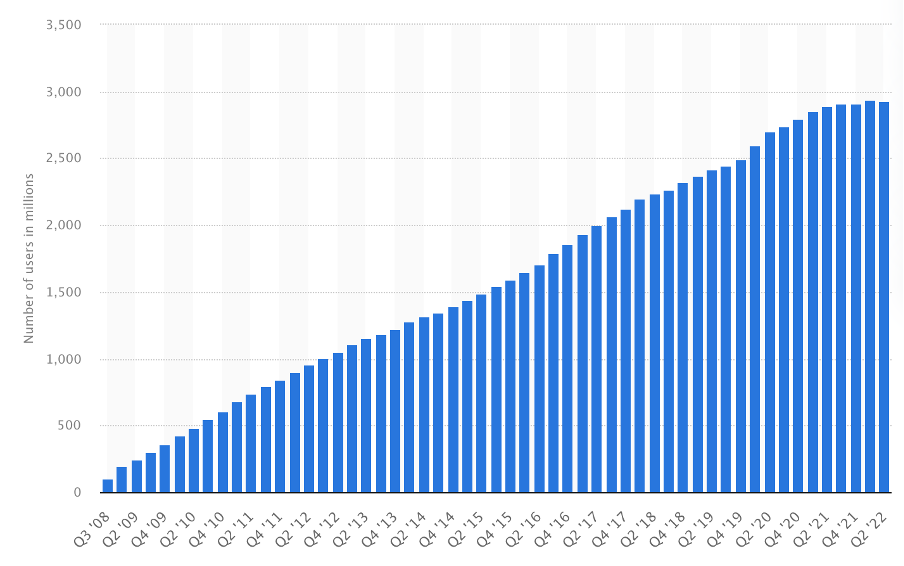

Since then, Facebook’s user figures have recovered, with monthly active user numbers increasing 4% annually to end June.

As of June 30, 2022, Meta Platforms has 3.65 billion monthly active users across its family of social media apps, including Facebook, Instagram, WhatsApp, and Messenger and 2.93 billion monthly active users across Facebook alone.

Facebooks Monthly Active User Numbers

Source: Statista

Meta remains the world’s most active social media platform, with roughly half of the world’s population using one of their apps every month.

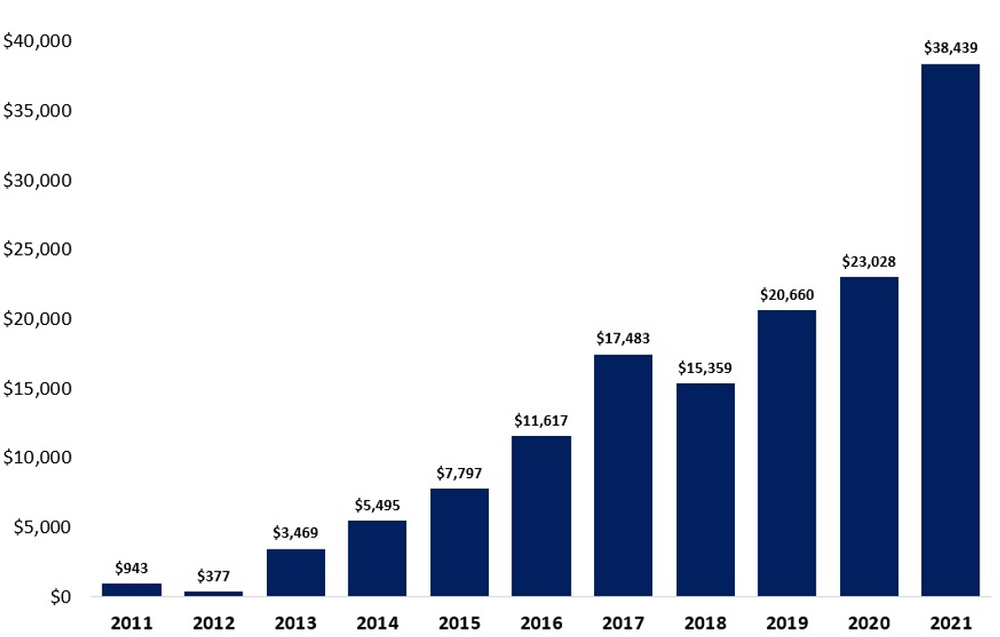

Facebook also boasts a powerful financial position with $50 Billion in net cash on the balance sheet alongside a business that continues to generate tens of billions of dollars in annual free cash flow

Facebooks Annual Free Cash Flow 2011 to 2021

Source: Statista

So, what’s the catch?

Falling Profits

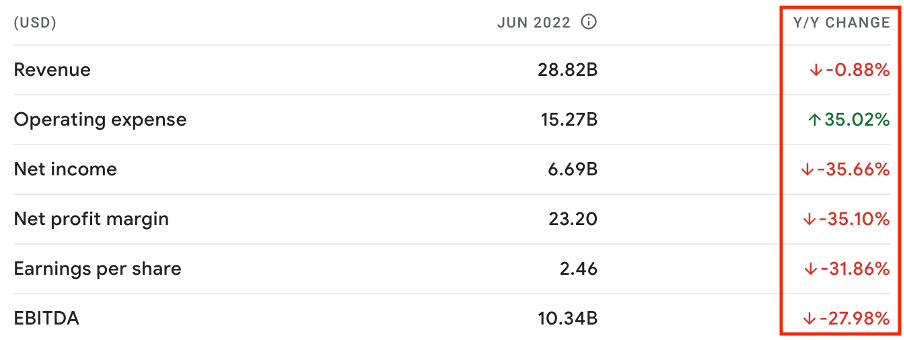

While the user numbers stabilised, pretty much every other metric turned catabolic.

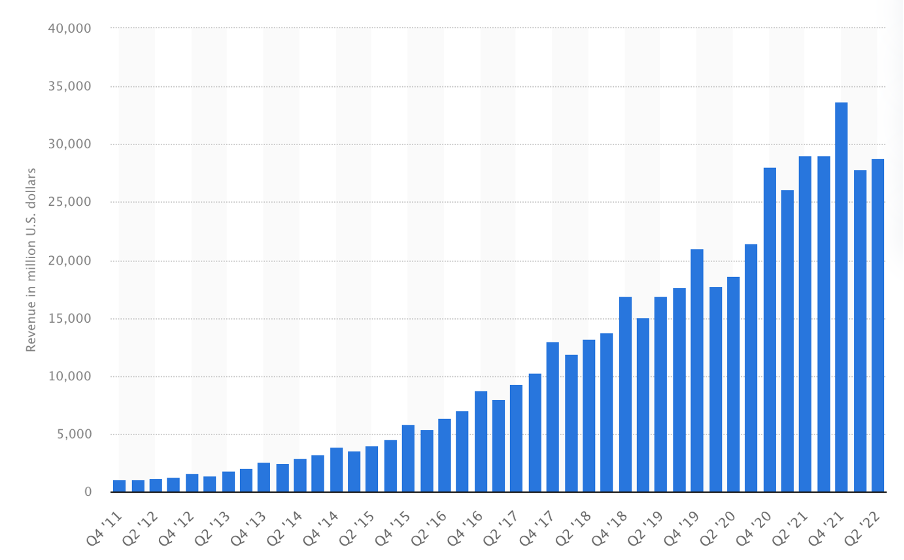

Meta announced their first-ever drop in revenues in its 2022 second-quarter results.

The firm’s Q2 revenue was $28.82 billion, down 1% on the $29.07 it recorded this time last year.

Meta Quarterly Revenue Numbers

Source: Statista

A 1% drop may not seem like much in isolation but remember, this is a company that recorded a 41.3% compounded annual revenue growth rate over the previous decade.

To add insult to injury, profits slumped by 36%, from $10,394 billion in Q2 2021 to $6,687 billion.

(I will run through the reasons for this dramatic drop off in net income shortly)

Q2 earnings summary

Source: Yahoo Finance

According to Meta’s chief financial officer David Wehner, the outlook doesn’t look set to improve any time soon.

“We expect third quarter 2022 total revenue to be in the range of $26-28.5 billion. This outlook reflects a continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty.”’

So where does ‘META go from here.

Is this an opportunity to buy one of the most successful companies of the past decade at a bargain price follow a knee-jerk over-reaction from investors or is there justifiable reasons to stay as far away as possible?

Triple Threat

Let’s start by looking at the factors responsible for Meta’s recent breakdown, and from there, we can determine if there are any viable escape routes.

Three major issues stand out.

-

- Apples Privacy Policy

-

- Growing Competition

-

- The Metaverse spending problem

The Apple Effect

Facebook has been warning of the challenge created by Apple’s privacy change for some time.

At the start of the year, CFO David Wehner stated,

“We believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion,”

The issue is, iOS 14.5 updates mean Apple now requires apps downloaded through the App Store to let users opt in or out of tracking their activity across third-party sites. With most users opting out, Meta Platforms has lost the data needed to create the targeted advertising businesses crave.

In short, the iOS 14.5 update was Facebook’s kryptonite.

The update is likely to have a considerable impact on Meta’s bottom line. The price advertisers are willing to pay falls dramatically as Meta’s ability to target their desired consumers decreases.

Evidence of this was seen in Q2 2022, with the company delivering 15% more ad impressions than a year ago. But the average price per ad fell 14%.

Meta is working on changes to make its ad targeting more effective, but there is no quick fix here. The aim is to use artificial intelligence to predict consumer interest as a substitute for tracking user activity.

Meta also hopes to leverage the knowledge gained from its commerce efforts within Facebook, Instagram and WhatsApp.

Both approaches are largely unproven and will take considerable time, but Meta hopes these changes will replace the information previously gained through tracking user activity.

With that said, Meta’s resources and expertise in ad targeting suggest it’s relatively well positioned to recover from Apple’s hit over time.

A headwind for now, but I wouldn’t write them off just yet based on iOS updates alone.

Growing Competition

For the longest time, Meta pursued growth through acquisition instead of innovation.

If their attempts to mimic competitors didn’t work, they would do what all great cash-rich behemoths do and buy up the competition.

I’m not sure you could refer to it as an economic moat, but it’s an effective monopolistic approach all the same.

At least, it was until TikTok came along.

Over recent years, Facebook’s stranglehold over all demographic loosened.

The median age of Facebook’s advertising audience (31) continued to increase as the younger demographic failed to engage.

This provided the opportunity for another platform to target this underserved demographic and capture significant market share before Facebook had a chance to undercut. An opportunity that TikTok took with both hands.

The monopoly is no more, and Meta is well aware.

Wehner stated on the Q4 earnings call,

“We believe competitive services are negatively impacting growth, particularly with younger audiences,”

TikTok was the only competitor mentioned by name.

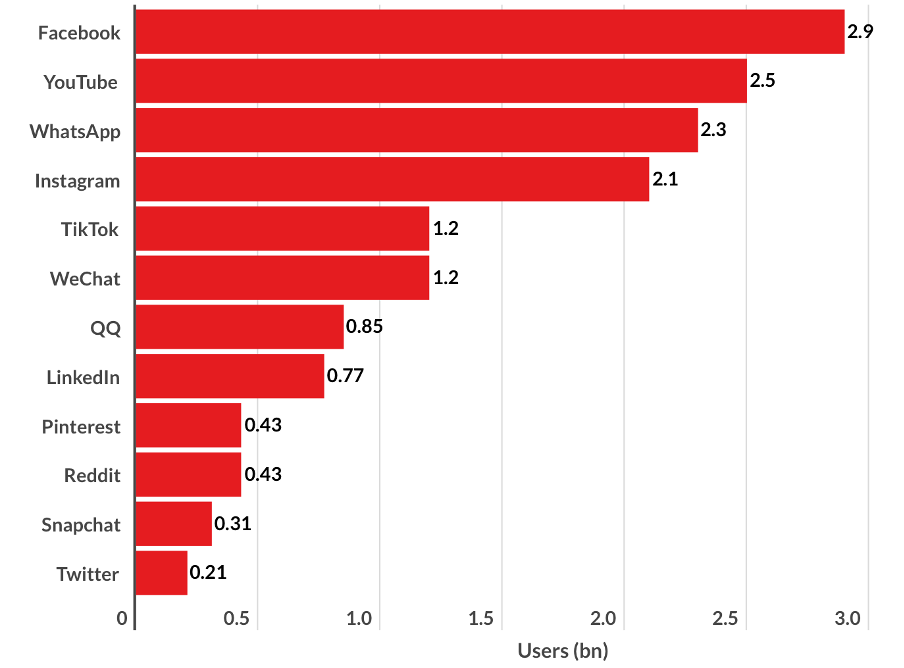

While Meta still holds a significant upper hand from a monthly active user standpoint, that doesn’t tell the whole story.

Number of Monthly Active Users Across Major Social Apps

Source: Business of Apps

‘Monthly active user’ numbers have always been the metric of choice in this space. While convenient, I have always had a bone of contention with it as a metric.

It tells you very little about the actual engagement of each user.

Surely engagement levels should be the metric of choice in a business where profits are determined by how much of your attention is robbed.

For example, I am technically a monthly active user of Facebook, but I haven’t engaged in the platform for more than 10 seconds in several years. I’d imagine I’m not the only one.

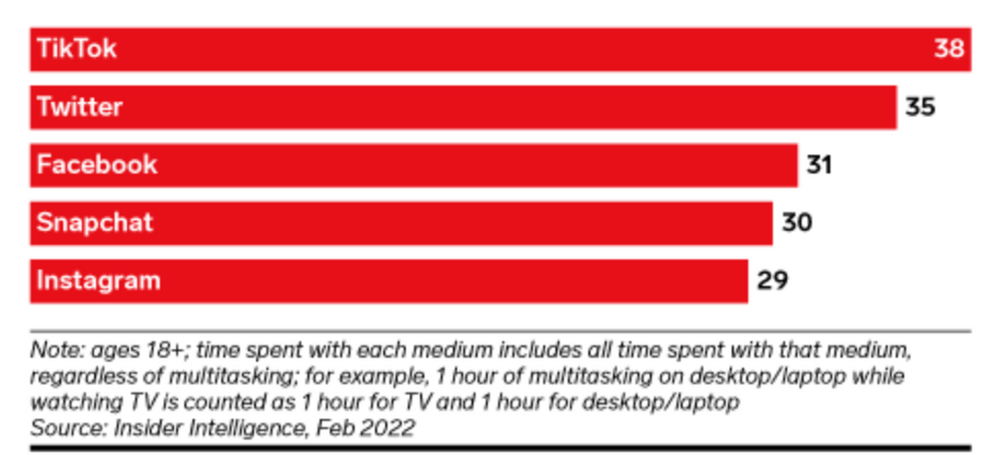

Time spent per user provides a far more telling insight into the overall potency of the platform.

When measured from an engagement standpoint, TikTok has managed to dominate the market in a very short space of time.

A worrying trend for Meta.

Average Time Spent per Day by US Adult Users

,(In Minutes)

Source: ,Insiderintelligience.com

Meta is not simply going to lie down and take this. They have already deployed their trusted “Copy and Paste’ techniques to try and regain some relevance.

Meta recently prioritised short-form video content to combat the TikTok threat and up its game with young adults, but this hasn’t exactly gone to plan.

Firstly, as a fledgling format, ‘Reels’ has relatively few ads relative to other Meta formats such as ‘Stories’ as it attempts to attract a user base. As such, ‘Reels’ functions as a revenue drag on the platform.

With that said, this has been improving, with the ad revenue from Reels reaching a $1 billion annual run rate in Q2.

Wehner said Meta is optimistic that, in the long run, increasing monetisation of Reels content “will be a tailwind on revenue, but that’s not happening in 2022.”

One catch, however, it appears that users aren’t necessarily on board with the plan.

Kylie Jenner and Kim Kardashian’s “Make Instagram Instagram Again.” Campaign resulted in a quick U-turn from Meta

They wrote:

“Stop trying to be TikTok. I just want to see cute photos of my friends. Sincerely, Everyone.”

In response, Meta quickly folded.

“We definitely need to take a big step back, regroup and figure out how we want to move forward,”

–Instagram CEO Adam Mosseri

This pushback will undoubtedly slow Meta’s planned transition into the short form video space but is unlikely to stop it in its tracks completely.

Room for Two

Meta is no longer the monopoly it once was and never will be. It is unlikely to ever gain the attention of the younger demographic, and user growth is likely to stagnate. But with half the world already using its apps, it still has an extraordinarily powerful network at its disposal.

Crucially this will allow it to generate tens of billions of dollars in ad revenue every year without dominating every demographic.

While the growth rate has slowed meaningfully, it’s worth noting Meta still generate ~$120 billion a year in revenue.

Growth expectations will need to be reined in significantly, but the cash cow is still alive.

The Metaverse Won’t Make Itself

Of the three, this is the variable I can’t quite measure, the unquantifiable number in the already complex equation.

The vision is clear.

“Our hope is that within the next decade, the metaverse will reach a billion people, host hundreds of billions of dollars of digital commerce, and support jobs for millions of creators and developers.”

But I’m not sure even Mark has been able to quantify how this one might play out.

“I recognise it’s expensive to build this – it’s something that’s never been built before, and it’s a new paradigm for computing and social connection.”

One thing is for sure, successful or not; it will take a bucket load of cash to create.

“Over the next several years, our goal from a financial perspective is to generate sufficient operating income growth from FoA (Family of Apps) to fund the growth of investments in FRL (Facebook Reality Labs) while still growing our overall profitability. That’s not going to happen in 2022 given the revenue headwinds, but longer term that is our goal and expectation.”

But why go to all this effort?

The creation of this immersive computer-generated three-dimensional world comes with the promise of an alluring multi-billion-dollar carrot.

According to a report from McKinsey & Company, the Metaverse could have a value of up to $5 trillion by 2030

Bear in mind, I would take these projections with a lethal dosage of salt.

Many of these forecasts hold about as much mathematical integrity as licking your finger and sticking it in the air.

The total addressable market for the Metaverse ranges from $800 billion to approximately $12.5 trillion, depending on your source. The disparity in the range should tell you everything you need to know about the accuracy of the calculation.

Regardless, there is money to be made for the company that cracks the market.

But for now, investors are being flogged with the stick, and there isn’t a carrot in sight.

It Doesn’t Add Up

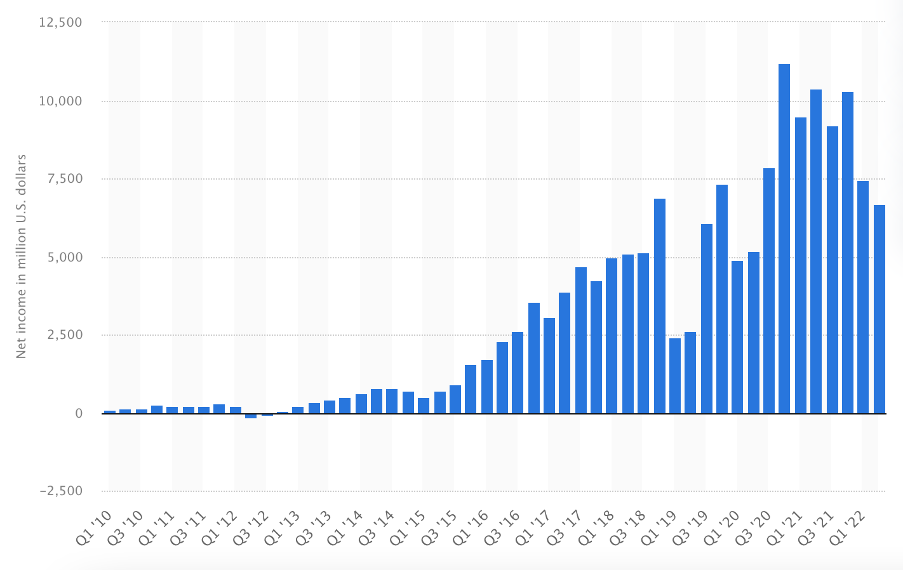

In Q2 2022, Meta’s Family of Apps — including Facebook, Instagram, WhatsApp and more — recorded an operating income of $11.16 billion on revenue of $28.37 billion. This represented a 25% drop in operating income compared to the same time last year.

Meanwhile, Meta’s Reality Labs division lost $2.81 billion in the quarter on revenue of $452 million.

With core business profits declining and reality labs losses growing, the net result was a ~$4 billion decline in Meta’s operating income. ($12.4 billion to $8.4 billion year over year).

Meta Net Income Decline

Source: Statista

On the one hand, you have the large and growing difficulties of the core business (apple updates, mounting competitions, user stagnation, mounting regulation) leading to a reduction in revenue.

On the other, an unproven project of massive scale continues to hemorrhage money despite the fact it is unlikely to be a material driver of the business at any point in the current decade.

Somethings gotta give.

Stop the bleeding

Last year’s comp numbers were always going to be tough to beat. The pandemic pulled forward demand, creating a surge in profits, but the rate at which Meta has given back these gains is concerning.

For now, the company must balance its immediate health against its long-term goals. They need to reign in spending.

Meta has exhibited a pace of expense growth over the past few years that is proving unsustainable as their growth stagnates.

This is something that Zuck and co, appear to be tackling.

“With our current business growth levels, we are now planning to slow the pace of some of our investments,”

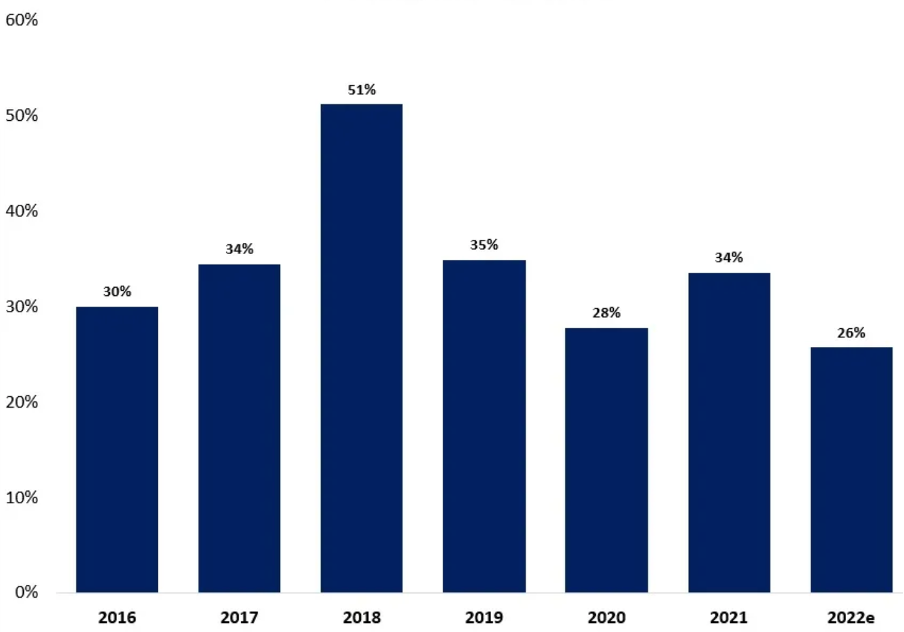

Meta has now revised its 2022 expenses guidance downwards. This reduced guidance still implies a 26% YoY growth in spending, but that would be the lowest pace of incremental expenses (%) in its history.

Meta Total Expenses

Source: The Sience Of Hitting

It’s a start, but finding the balance will take time.

Virtual Improvements

As well as a reduction in spending, investors will need to see some progress from Reality Labs. Showing measurable improvements will be a crucial part of holding investor conviction.

As it stands, recent glimpses into Meta’s virtual world have been borderline tragic.

Last week, Zuckerberg posted to Facebook announcing the release of Meta’s platform ‘Horizon Worlds’ in Spain and France. The post was accompanied by a “selfie” of Zuck’s avatar in front of a comically simplistic rendering of the Eiffel Tower and Barcelona’s Basílica de la Sagrada Família.

The project is clearly in its infancy, but early signs are more reminiscent of a botched version of the Sims.

I think it’s fair to say this was an embarrassing result given the $10 billion Meta poured into the Metaverse.

My View

Personally, the Metaverse sounds like a dystopian nightmare guiding us towards real-world isolation, but my opinion doesn’t matter here.

Of course, It’s easy to be cynical at the outset of new ventures.

“First, they laugh at you-then they copy you.”

Despite my snipes, I’m trying to keep an open mind.

But for now, the jury is still out on whether Zuckerberg can pull this one off without driving the company off a cliff first.

The “future of how humans and businesses will interact digitally” is clearly a long way off, but to create Zuckerberg’s vision, Meta must maintain their relentless spending rate.

With that said, if anyone is going to be able to pull off this audacious idea, it’s Meta.

With tens of billions of Free Cash Flow being generated annually and a network of 3.6 billion users at their fingertips, it’s not beyond the realm of possibility.

The Verdict

Before I can get on board,

-

- spending will need to be controlled until the core business stabilises.

-

- Reality labs must improve their virtual world offering to justify their multibillion-dollar spending habit.

For now, the stick is full of thorns, and the carrot only exists in Zuckerberg’s imagination.

Price

This is the allure. The dangerously seductive catalyst that spurred this entire story.

The price is what piqued my interest in Meta in the first place.

When a company that has changed how the whole world lives and interacts loses $500 billion in Market Cap, it deserves a second look.

Meta has fallen over 60% from its highs in September 2021.

Meta Stock Collapse

Source:TradingView

Meta still isn’t exactly cheap, with a $400 billion valuation. But with the stock falling even more than earnings to this point, Meta has become a potential value play.

It has a price-earnings ratio of 12.4 vs. 20 for the average S&P 500 stock and is trading at a significant discount to Meta’s five-year mean of 27.9.

While the castration of Meta’s valuation metrics were somewhat merited, The new lower levels allow plenty of potential upside — if Meta can weather current challenges and begin to capitalise on its Metaverse investments.

But as discussed, that’s a big ‘if’.

Final Word

Colour me intrigued.

On paper, there is no denying that Meta looks cheap but there is always the possibility of earnings getting decapitated from here.

Its outlook is now tainted by user growth concerns, increased competition, regulatory issues and a debilitating spending problem.

Personally, I believe Meta can steady the ship and stabilise its user numbers.

Their core business will continue to be an ultra-profitable endeavour but just not at the same clip as before.

From here on out it will be about fighting to keep the user levels they have as opposed to the endless user growth we have become accustomed to.

If you’re bullish on the Metaverse, then it’s a no-brainer. But if like me, you’re reluctant to jump aboard the Metaverse bandwagon just yet, then some more time on the sidelines is advised until a more concrete business vision is unveiled would.

For now, any chances of a sudden rebound are greatly diminished by the recession clouds that hover overhead.

But if I’m being 100% honest, the price is starting to become too attractive to ignore.

A small, albeit risky play may be on the cards to start.

Plenty of volatility ahead, but all is not lost.

Viva La Metaverse.

This is not investment advise. Do your own due diligence before making any investment decisions